Everything wrong with American education

American politicians nationwide debate on a free college education option for their citizens, and carefully consider the pros and cons both economically and socially. They must decide between a nation with educated citizens or a nation in deep debt. While the public discusses a free, but also high-quality education option, college students nationwide endure several financial problems interfering with their education and personal lives.

March 11, 2022

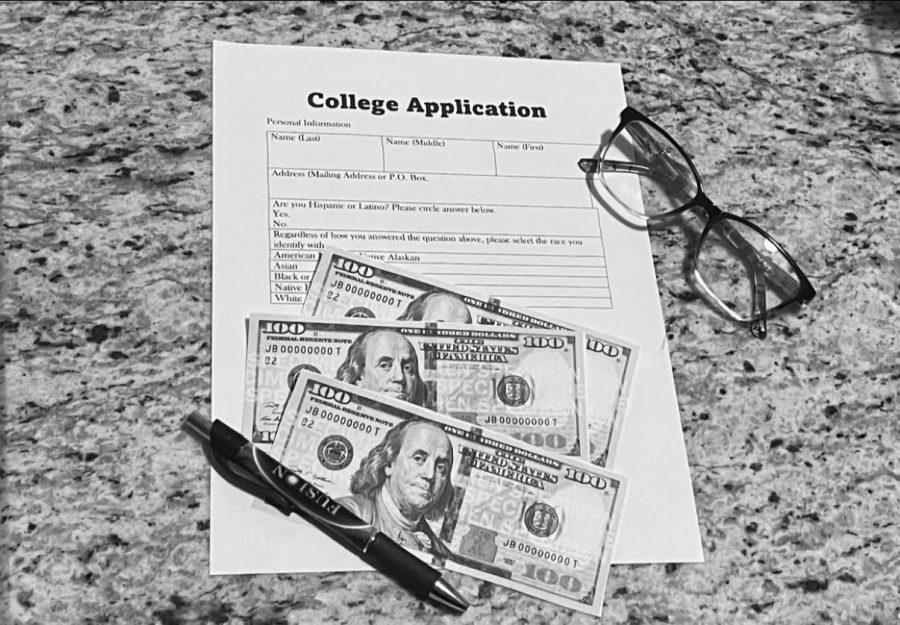

As students approach the end of their senior year, they must make one of the most important decisions in their lifetime. At the age of 18, they must decide if college will hurt or help them in the long run, and their choice will heavily impact their future in almost every way. The average cost of tuition nationwide for public colleges for out-of-state residents rounds up to $28,000, but the average American household only earns around $69,000. America should create a free college education option to adhere to the exceedingly low pay Americans earn per year, and the excessive student loan debt nationwide.

Twenty-four countries throughout the world provide higher education to their citizens free of charge. American leaders call the U.S. a free country and pride themselves in the quality of education, yet they do not provide a free education option for their citizens. A free education provides several positive factors even America itself would benefit from. The U.S. would expand its workforce and gain a clever society by granting everyone access to all forms of education.

Several careers require their applicants to obtain a minimum of a bachelor’s degree before hiring them, but employers do not realize the financial burden of the degree itself. People often refer to the term “spend money to make money”, but when earning a degree, the majority of students do not make the money they spent back. 1 in 8 American adults suffer from student loan debt nationwide and will struggle to make enough money due to low wages throughout America.

Only 32% of students from the lowest economic class enroll in college to obtain a bachelor’s degree, and 42% of the students from the same class push toward an associate’s degree. Several of the 42% will struggle to find a career and support their family because American employers do not look for employees with an associate’s degree. This proves that the cost of attending a university affects not only the parents’ pockets but also the young adults when they graduate.

On the contrary, a free university-level education option will negatively impact America’s economy. America’s government would need to put out money for teacher salaries and learning materials such as textbooks. Despite the negative effects on America’s economy initially, free public universities would improve the economy by creating new jobs. America will need to take the risk to spend money to make money because a free college system will eventually pay for itself. A public university provides a benefit to not only people in need of education but also America’s economy with a broad workforce.

“To pay for [free public universities] we would have to increase taxes or cut spending in other areas. One would expect the tuition to go up for schools with [the demand for spots in a university,] and a lot of competition. It happened in the University System in Georgia when the HOPE Scholarship was created. [Although,] I am for tuition assistance and loan forgiveness for people entering fields where we need more workers. For example, there are areas of the country that can’t get teachers or doctors. Assistance to those who [are] willing to go work in those areas for a specified amount of time could be beneficial,” AP government teacher Steven Butler said.

Additionally, college students suffer to make ends meet with the tuition they pay annually. College students must balance their personal bills along with tuition itself. A soaring 81% of part-time students and 43% of full-time students work more than 20 hours a week while enrolled in college. Students attempt to balance work and school life, but at the end of the day, their personal needs take priority. College students should not need to decide between their education and paying rent, yet students make this choice by walking into work.

“I have struggled with college financially when it comes to living on my own or paying rent and putting food on the table. Most, but not all college students generally move out around that age, so while students are taking on harder classes and navigating through what they want to do with their lives, many are also simultaneously stressing about living on their own. High school students and younger still have their parents. Worst case scenario you don’t make money, dinner is still on the table. In college if you don’t make money, you might eat, you might not,” Kennesaw State University student Alli Hicks said.