Rising gas prices: Who takes the blame?

Crude oil, the most valuable commodity by trading turnover and one of the most widely used, experiences frequently fluctuating prices. Recent prices have hit an all-time high, and in a world with unlimited consumers and producers, no single country or organization can take the blame. Everyone in the global market contributes to this industry and consumers take the blunt force of these trends.

March 31, 2022

Although first physically pumped in the mid-1800s, oil did not become the most important source of energy until the mid-1950s. Since then, society has created a strong dependency on it, with oil becoming the lifeline of all industrialized nations. The increased demand for the popular product requires not only an increase in supply but also an increase in price. However, even when this limited energy source decreases in supply, the unwavering demand stays constant. As a result, this oligopolistic industry can rack up prices, and customers face no other choice but to buy the essential product.

Current gas prices provide the perfect example of this phenomenon. As of March 24th, the average gas price in the United States hit $4.23, the highest price ever, not including inflation. The drastic increase brought about anger and accusations as people attempted to pin down the cause behind the issue.

Contrary to popular belief, the cause does not trace back specifically to the US and its government, since this global issue includes all industrialized countries. The president does not control the market and possesses no control over gas prices, so any inflation and increase in prices can only come from the global market and consumer habits. Changes in demand may result from consumers’ future expectations of the market, so if everyone believes gas prices will rise in the future they will buy more, and, ironically, prices will proportionally rise.

This may result from tension in other countries and consumers’ fear of how that will affect them. The issues in Ukraine and increasing global conflict raise stress and anxiety and the uncertainty causes people to plan for any possible outcome. With the recent ban on U.S. importation of Russian oil, the supply chain will take a hit.

At the root of this period of inflation rests the pandemic, which takes the blame for the economic pummel in 2020. Numerous industries faced hardships during this time and now want to maximize profits to recover. OPEC and its member countries collectively decide how much oil they want to produce and what to price it at. OPEC and Russia together account for just over half of the global production of oil, so the US relies heavily on their oil reserves. Since production decreased significantly at the beginning of 2020, OPEC and its members must now return to full production. Yet, this slow increase in oil production cannot keep up with the world’s demand, resulting in high prices.

“Gas prices are based not necessarily on just supply and demand but also speculation about what will happen in the future. So the concerns that are going on with Russia are because it is such a large oil and gas producer and so it’s driving the prices up, but also companies are trying to make large amounts of money,” economics and government teacher Tara Sisino said.

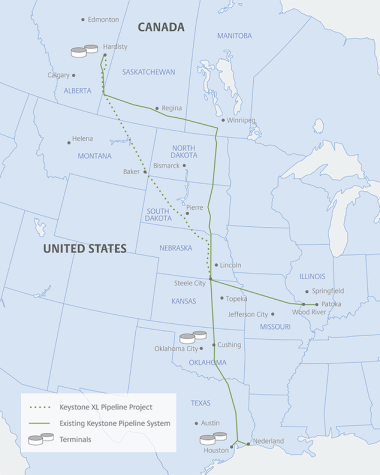

A common misconception places the blame on the recent cease of construction of the Keystone XL (KXL) pipeline. This pipeline would run from Canada to Nebraska and then connect to the main Keystone pipeline that runs from Canada to the Gulf of Mexico. The main pipeline, built in 2010, remains in operation today, but the fuel put into it belongs to Canada, not the US. The fuel then becomes exported, so none of it stays in North America for domestic use. This process would have applied to the Keystone XL as well, if it became fully operational. A small portion of the oil could remain in the country, but the majority would continue to China or other countries.

“I’ve opposed the Keystone strategy for a long time because it is an export strategy. It doesn’t even have any oil for America to make our gas prices cheaper, it’s literally oil from Canada taken through America, so we take all the risks of any kind of spill or any kind of problem, and then it exports it to Mexico and then straight to China or other places,” U.S. Sen. Kirsten Gillibrand said.

The KXL shutdown correlates to its effects on the environment and surrounding wildlife, but since construction did not reach completion, and would not achieve it until 2023 at the earliest, it contains no possible correlation to the current rise in gas prices. The battle over this pipeline began over a decade ago when Obama still resided in office, and he declined its permit as well due to its plans to extract tar sand oil.

Ultimately, the blame cannot fall on President Biden or the U.S. government, but rather on the corporations that supply the oil and current world events. They set the prices and control the market; the Keystone XL pipeline just entered recent light and happened to take the blame. High inflation naturally occurs as the economy grows, and with a little push, prices will eventually fall.

“The gas prices rising have been really annoying, especially for teenagers who don’t make a lot of money. I’ve heard a lot of different people place the blame on Biden or Russia, so I have no idea what to believe. I just hope the prices drop soon,” senior Joshua Leblanc said.