As February begins, President Donald Trump approaches his second term in office with bold tax policies. As one of Trump’s first executive decisions, he imposed tariffs on Mexico, Canada and China. Due to the increase of undocumented immigrants and the threat posed by illegal drugs, Trump decided to use tariffs as a way to address his concerns.

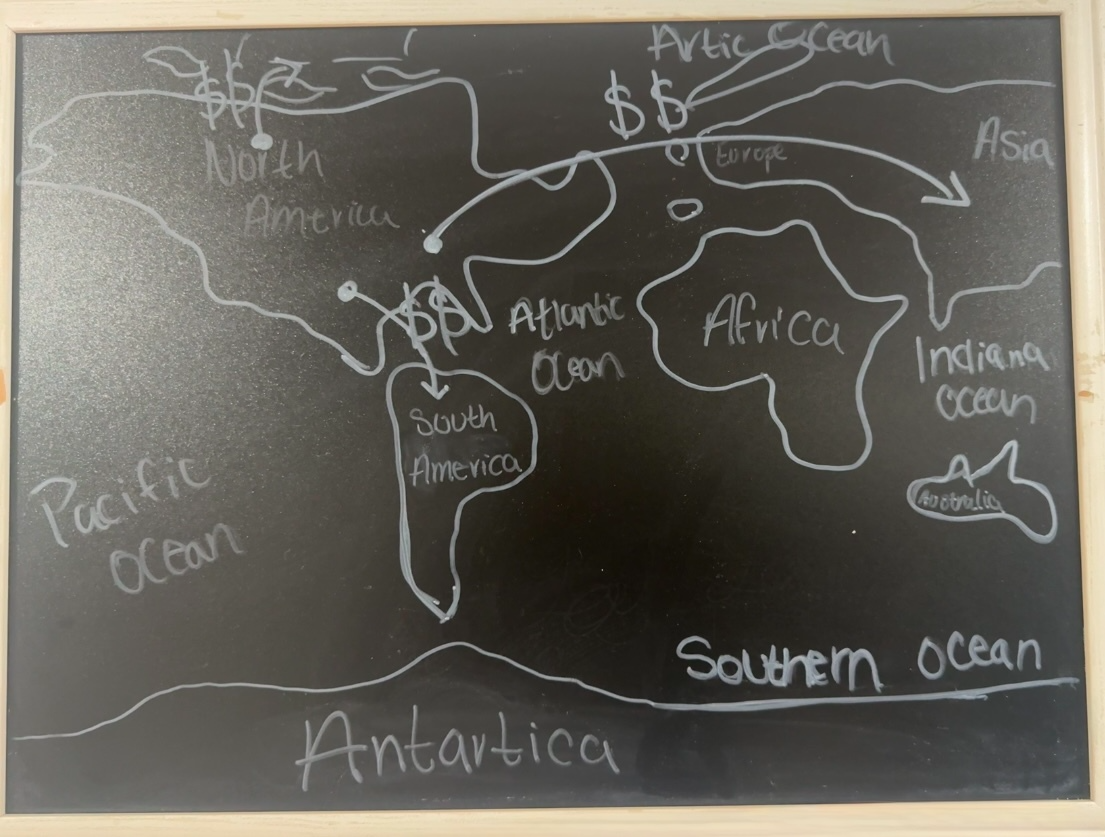

After the establishment of tariffs through three executive orders, President Trump stated that implementing tariffs would help the American economy protect the country from major threats of illegal aliens and drugs. To simmer down the situation, Trump decided to possibly implement a 25% additional tariff on imports from Canada — aside from energy resources — as well as a 25% tariff on Mexico while executing a 10% tax on goods from China. After the tariff set on China, products that normally cost around 10 dollars automatically include an additional one dollar charge towards materials purchased in the U.S.. In Canada and Mexico, Trump decided to hold out on imposing tariffs for another month as long as the two countries agreed to boost border security. China’s additional tariffs took effect February 4 according to the Chinese government, meaning a minimal amount of time remains before the countermeasures fully sink in.

The introduction of tariffs on goods from China by President Trump immediately reflected on the U.S., with China announcing similar charges on U.S. imports as retaliation. Moments after President Trump’s 10% charge on all Chinese products took effect, Beijing retaliated with tariffs on U.S. coal, gas and other goods. Economists estimated that China’s proposed tariffs would cover about $20 billion of U.S. exports, compared with Trump’s tariffs on a scale above $450 billion of Chinese goods. Trade experts suggest that China’s response to the tariffs — which Trump called an opening salvo — seemed predictable due to the short-term damage but they withheld from the full range of actions they could take if the trade dispute increases.

“Once the tariffs are implemented, we won’t be able to buy anything from other countries, famines will begin, and our society will fall apart as a functioning civilization. Especially since we get most of our resources from our neighboring countries. The tariffs will not aid or affect illegal immigrant security especially because of the aggressive approach. I believe the laws that execute a process for immigrants to migrate to the states should be all there is for immigrant settlement,” NC parent Deborah Davis said.

January 31, 2025, while speaking with reporters in the Oval Office, President Trump entertained the virtue of tariffs and stated that the recent actions on Canada, Mexico and China represent the first steps of additional U.S. tariffs. President Trump stated that he intends to impose additional tariffs on imports from the European Union (EU) as well. In addition, Trump plans to impose tariffs on a number of products such as steel and aluminum around the world and he will continue to apply additional tariffs on imported semiconductors concerning oil and gas starting February 18. About pharmaceuticals, he did not provide a specific date but clarified that he wanted to bring production back to the U.S. by putting up a tariff wall. Industries pertaining in pharmaceuticals prepare to face potential disruptions such as drug shortages and increased prices and force manufacturers to reevaluate their market strategies. It remains unknown of the full impact of the proposed tariffs on pharmaceutical companies, but the effect may prove critical to the U.S.’s medical support.

“With increasing tariffs on things like goods from Mexico, Canada, or China, trying to buy something that is being imported from China will be about 10% more expensive e. I do not believe that the tariffs will take effect on undocumented people but rather his action to increase detentions and expulsion centers will show a more positive change. I am generally in favor of diplomacy and using the State Department and regular diplomatic order through the United Nations as a means by which to negotiate, rather than strong man tactics,” Advanced Placement (AP) Comparative Government teacher Carolyn Galloway said.

As a result of the assumed future tariff walls, companies that import products into the states from China may consider migration strategies. Companies that import into the states from Canada and Mexico should analyze how they could face the effects if the now-suspended tariffs prevail within the on- month suspension. For instance, companies will need to confirm that they continue to use the correct legal standard to determine the country of origin of materials imported from Canada, Mexico and China. As the numerous tariff laws continue, companies will need to learn to adapt to the new implementing trade laws.

In a broad sense, the rapidly changing developments for Trump’s second term highlight the need for companies to prepare for the imposition of tariffs. All companies that rely on imports to the U.S. should take steps to understand their supply chains and identify potential alternative sources of supply so that they can react quickly when tariffs become an obstacle.