Working teenagers likely know the struggle taxes present. Each paycheck cut down by Uncle Sam disappoints an eager worker who knows the hours he or she put in for each cent. With the sun of tax season swiftly rising, teenagers gain the opportunity to receive a refund for their taxes, or at least avoid a run-in with the Internal Revenue Service (IRS).

“Most teenagers make below the amount, so they will actually get money back from taxes, so if they file, they’ll actually get refunds, so why wouldn’t you? The best advice is there’s a free file function on the IRS website. Because their income is below a certain threshold, they can file for free online, they don’t have to pay anything and it can be done very quickly and easily. Obviously they should speak to the adults in their life and [realize] that their parents are claiming them, but it’s a great opportunity to practice something they’ll be doing for the rest of their life,” Advanced Placement (AP) Microeconomics teacher Tara Sisino said.

The majority of teens work clear-cut jobs in industries such as food service and retail. For income sources such as these, the tax process maintains clarity, with the IRS offering opportunities for free filing on its website. For teens with investments, retirement accounts and other less traditional income sources, the tax process can grow in complexity. With software programs such as Turbotax or its free online alternatives, young people can feel their coined confusion melt away.

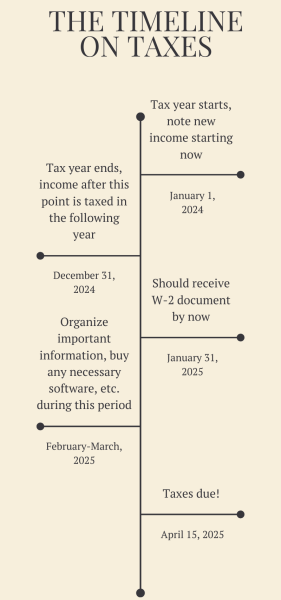

Typically, workers should expect to receive a W-2 document from their employers. This document details the wages a person receives throughout the year, what the government already charges and other tax information depending on the region. People who have worked for multiple employers throughout the year should only file once, but they should file with the quantity of forms they receive. Once a taxpayer has compiled all of his or her information, he or she can visit a post office to receive a paper copy of form 1040 to mail to the IRS or file online through a software program. Essentially, this form guides the filer through the process by asking a series of questions regarding the information on the W-2.

Ultimately, nearly all Americans will file taxes in their lives. While it may feel terrifying initially, the task eventually transitions into a simple, surmountable annoyance with education and practice.